To sustain timely performance of daily activities, banking and financial services organizations are turning to modern accounting and finance practices. Calculate and identify account balance and activity fluctuations automatically to continuously monitor for risk, ensure the effective and timely execution of critical management review controls, and support agile decision-making. Before we get into the account reconciliation process, let’s back up and think about the who, what, and when of the reconciliation workflow. This is the one that keeps business owners and finance and accounting professionals up at night. While some fraudsters exhibit a true evil genius in covering their tracks, most thieves aren’t that clever.

Add and subtract these as appropriate until you can get both sides to match. Next, match the entries in the general ledger with transactions on the statement. Adding to the challenge, sometimes an entry in the general ledger may correspond to two or more entries in a bank statement, or vice versa. Reconciliation is a process that may benefit businesses as this may help avoid balance sheet errors which may have led to detrimental ramifications; in addition, reconciliation may help against fraud and can help instil financial integrity.

Personal Reconciliation

It’s also an important outcome, since GL balances flow into a company’s financial statements, which are used for internal and external decision-making. Account reconciliation of all GL accounts is a best practice that businesses should have in place — and it’s even better when the process is automated. There are four primary reasons for doing account reconciliations, although there are many other benefits as well. Second, regular comparisons to outside information can uncover fraud and anomalies. Third, the balances on balance-sheet accounts — assets, liabilities and equity — persist from one fiscal year to the next, so detecting and correcting discrepancies is critical to avoid perpetuating errors. Fourth, external auditors require and review account reconciliations when assessing a public company’s internal controls environment and fraud risk under the Sarbanes-Oxley Act.

The reconciliation process happens at the end of every reporting period–monthly, quarterly and annually–to ensure every GL account matches the balance of its corresponding sub-ledger or external transaction system. The process typically involves three distinct stages once the initial books are closed, and trial balances are created for the period. A well-planned account reconciliation process includes an audit trail, workflow automation and supporting information to ensure that all accounts balance out. But at the same time, the process is transparent and clearly justified for everyone involved. Getting accurate records is one of the most important steps that affects your future reconciliations. Neglecting this essential step leaves your company’s finances open to manipulation and potential fraud.

Mastering Reconciliation

There also allows leadership to spot processing errors caused by duplication and calculation mistakes. While reconciling the bank account, you may find that bank fees have gone up and your company is paying unnecessary fees related to overdrafts. You may even discover some transaction fees could be eliminated by switching the bank account type you currently use. The process of comparing a company’s balance sheet with the company’s records of transactions to guarantee that all transactions have been correctly accounted for is referred to as balance sheet reconciliation.

- Reconciliation tasks include balance checking, identifying duplicate entries, and correcting mistakes where necessary.

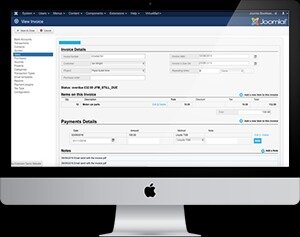

- An overwhelming majority of businesses today use accounting software to record their transactions and help regulate differences between their books and supporting financial statements.

- According to the survey, up to 59% of financial department resources can be spent on managing transactions.

- For instance, e-commerce businesses may struggle with accounting processes due to a large number of the sales channels they use.

- Because the balances of asset, liability and equity accounts are carried forward each year, account reconciliation is required.

The best option for your business mostly depends on how many transactions you do. Knowing how to reconcile accounts can be helpful, but you can save time and money by using Ignite Spot’s outsourced accounting services. Our financial experts can perform accounting reconciliations as often as your business needs. Reconciling accounts and comparing transactions also assists your accountant in producing credible, accurate, and reliable financial statements. In order to ensure the integrity of an entity’s financial reports, it is important that each entity performs account reconciliations on a regular basis. By performing account reconciliations as part of normal close accounting procedures, the university can produce reliable and accurate financial statements free from incorrect or misleading information that could result in false conclusions.

How to Effectively Implement Account Reconciliations

For both internal and external sources, every balance must match its corresponding account in the GL. Inter-company transactions, currency exchange rates and various non-cash activities only generate more complexities in an already complicated, time-consuming process. It compares transactions recorded in your ledgers to the monthly bank statements. Most transactions, including payments and earnings, are recorded by the bank. So, reconciling bank accounts can help spot discrepancies in checks issued or missing transactions. Reconciling accounts is a crucial internal control measure to ensure accurate financial reporting.

- Create, review, and approve journals, then electronically certify, post them to and store them with all supporting documentation.

- Failure to detect these errors may lead to issues concerning internal controls or the accuracy of the financial statements which impacts future funding from government organizations, creditors, or individual donors.

- Finance and accounting expertise is not only needed to prevent ERP transformation failures, but F&A leaders are poised to help drive project plans and outcomes.

- Automation software spares you the inefficient and tedious work involved in account reconciliation.

- The month-end close, adjusting entries, posting to the GL and generating financial statements and reports are only part of the story in what’s referred to as the full-spectrum of FP&A activities.

While there are tools for account reconciliation that handle a large chunk of the work, you still need someone to compare the records. Read this blog to learn more about how your organization can improve the account reconciliation process. Upon further investigation, it is identified that the company recorded bank fees of $1,000 rather than $100. As such, a $900 error should be noted in the reconciliation and an adjusting journal entry should be recorded. Many organizations are unable to complete the reconciliation process in a timely manner, which introduces risk.

Plus, you can set accuracy thresholds to determine whether transactions need to match to the penny, or if being off by say 5% is close enough. Many people reconcile their checkbooks and credit card accounts periodically by comparing their written checks, debit card receipts, and credit card receipts with their bank and credit card statements. There are several steps involved in the account reconciliation process, depending on the accounts that you’re reconciling. Bank Reconciliation involves determining exactly how much money your business has in the operating checking account at a given period.

Failure to pay suppliers is bad for business as being behind on payments can result in a loss of service or goods from key external stakeholders. These deteriorating supplier relationships can result in business output being affected due to demand from customers no longer being able to be met. Upon further investigation, it is identified that the Company wrote a check for $10,000 which has not yet cleared the bank. As such, a $10,000 timing Free Profit and Loss Form Free to Print, Save & Download difference due to an outstanding check should be noted in the reconciliation. Explore the future of accounting over a cup of coffee with our curated collection of white papers and ebooks written to help you consider how you will transform your people, process, and technology. F&A leadership can have a significant impact by creating sustainable, scalable processes that can support the business before, during, and long after the IPO.

Importance and Impact of Account Reconciliation

Whenever a manual entry is introduced to the company’s general ledger, there is always a probability that a human error will be made. For instance, common mistakes may include a credit account may be posted as a debit, having some numbers accidentally transposed, keying in the wrong coding, or having duplicate journal entries. Given that such incidences are genuinely inevitable, it is critical to ensure that accountants consistently double-check for minor mistakes such as these whenever they are reconciling the account balances in the general ledger. Overall, this is a vital component of the general ledger reconciliation procedure, as the accountant needs to substantiate the account balances in the firm’s general ledger. Crucially, the general ledger should never be viewed as an official report of the company’s performance but rather as a set of raw data that accountants utilise to provide useful business reports. After finding evidence for all differences between the bank statement and the cash book, the balances in both records should be equal.

Companies which are audited will have the validity of their financial statements put under greater scrutiny due to the audit process, testing whether they are accurate and free from material misstatement. Alternatively, businesses with a field sales team will have to reconcile the value of employee expenses payable with the individual balances of submitted expense reports. There is more likely to be difference when reconciling if part of the expenses process is performed manually. Historically, reconciliation accounting was a relatively manual process, with the reconciliations themselves taking place in an Excel spreadsheet or on physical pieces of paper.

Often the cash balance in the book of accounts and the bank accounts may not match. This could be due to many causes like missed entries, bounced payments, charges incurred, interest accrued, and much more. While the entries in the general ledger are based on the facts of the moment, they may not always be accurate.

The revenue cycle refers to the entirety of a company’s ordering process from the time an order is placed until an invoice is paid and settled. The inability to apply payments on time and accurately can not only lock up cash, but also negatively impact future sales and the overall customer experience. Adapt and innovate with a hyperconnected Accounting function and give everyone the insights and freedom to thrive by connecting your data, processes, and teams with intelligent automation solutions for accounting needs. Streamline and automate intercompany transaction netting and settlement to ensure cash precision.Enable greater collaboration between Accounting and Treasury with real-time visibility into open transactions. Integrate with treasury systems to facilitate and streamline netting, settlement, and clearing to optimize working capital. Understand customer data and performance behaviors to minimize the risk of bad debt and the impact of late payments.

Account reconciliation is an internal control process that compares a company’s GL balance with a second source to determine its validity and accuracy. Because account reconciliations are tedious and time-consuming, they are often done after the financial close, or they are delayed or even overlooked. Automation can help companies avoid being in this unfortunate position and allow businesses to capture the many benefits that account reconciliation provides.

NetSuite Cloud Accounting Software includes built-in banking integration with automatic data imports from bank and credit card accounts and matching software, which does all the heavy lifting of bank reconciliation. Exceptions are flagged for investigation, allowing staff to skip to step five in the reconciliation process, which calls for determining whether corrective action is required for each reconciling item. Further, the simplified chart of accounts helps eliminate miscoding, which is one of the most common causes of reconciling errors.

For example, when your company makes a sale, it will debit cash or accounts receivable (AR) on your balance sheet and credit revenue on your income statement. Conversely, when your company makes a purchase, the cash used would then be recorded as a credit in the cash account and a debit in the asset account. The value of automation is even more apparent if your organization has subsidiary companies or separate but related corporate entities.