Contents:

The head and shoulders is a formation on your chart that shows the reversal of an up-trending market. Another critical thing you need to remember is that the head and shoulders pattern works best on higher timeframes like daily, weekly or higher. For a head and shoulders pattern, the primary method you can use in setting profit targets is the measured objective. This is the traditional way of setting a profit target on the head and shoulders pattern.

- The beauty of most technical trading patterns is that they can be used in whatever market you are used to or are trading.

- The Inverse Head and Shoulders is observable in a downtrend and indicates a reversal of a downtrend as higher lows are created.

- This method is not perfect, but if used correctly should be a great addition to your trading system.

- Here is how we get an excellent position even before any suspicions about a potential reverse H&S pattern have appeared.

- If a head and shoulders forms but the price rallies above the pattern rather of dropping below it, this signifies an extension to the upside, not a reversal to the disadvantage.

The measured move acts here as the base for projecting the risk/reward ratio, and such a ratio should be used every time a trade is opened. In doing that, the trader is disciplined and has a trading plan, which allows for only one winning trade with every 2.5 trades to be enough to stay in the market and not lose money. In the example above, the neckline was retested, but again, this is not a mandatory thing to look for. Sometimes traders stubbornly look for the retest, and in doing so they end up on the wrong side of the market. This measure move may only be orientative and it may reverse the trade.

Trading the head and shoulders top and bottom patterns

That is a pattern that looks like a head and shoulders but doesn’t perform like one. But there are a few key insights I want to share with you before you go. Think of these as rules to follow when trading the head and shoulders pattern. The first way to enter a head and shoulders break is to sell as soon as the candle closes below support. Finally, bilateral chart patterns can move either way, although they have slight statistical biases to either one side or the other. Wedges are a special sort because they have a solid directional bias but not a trend bias – thus, they can be reversal or continuation patterns.

IC Markets are my top choice as I find they have tight spreads, low commission fees, quick execution speeds and excellent customer support. These highs and lows are confusing for some traders, and sometimes there is a significant drop in price on one of the shoulders. Besides this, the Head and Shoulders Pattern can take a long time for its appearance. The formation of the pattern is based on a peak , followed by a higher peak , and then another peak .

Although using a measured objective is more aggressive as your target is further away from your entry, it’s also more universal. Knowing when to take profit can mean the difference between a winning trade and a losing one. Because any daily close back above the neckline suggests invalidation. And I don’t know about you, but I’d rather take a 50 pip loss than a 100 pip loss. To put it in hypothetical terms, that’s a 7.2% profit versus an 18% profit, assuming you risked 2% of your account balance on the trade.

How do you invalidate head and shoulders?

The Head and shoulders formation is one of the must-have skills for any Forex trader, especially if you want to make a name for yourself in the Forex market. Then we told you how to read these graphs and some of the rules that you must follow when using the Head and Shoulders strategy for trading on the Foreign currency market. These courses are developed by Forex markets experts who have years of training Forex traders. One of the most important rules you always have to remember when trading using the Head and Shoulders charts is that you have to be patient.

Once again, Canada blows away jobs estimates – FOREX.com

Once again, Canada blows away jobs estimates.

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

Notice how the volume picks up as we get through the right shoulder, basically peaking around the decisive breakout. Furthermore, notice how a pullback falls slightly short but still offers an opportunity for those late to get in. An Inverse Head and Shoulders, also called a “Head and Shoulders Bottom” is a reversal chart pattern.

Rule #1 – (head and shoulders price pattern rules): Find an uptrend on your chart

Whether it be OTC, Forex, options, stocks, cryptos, you name it. The head and shoulders pattern is applicable in any market that allows you to chart price movement. (0.24) First of all, it is a reversal pattern, a classic reversal pattern which is part of technical analysis. The head and shoulders is a pattern used by traders to identify price reversals. A bearish head and shouders has three peaks, with the middle one reaching higher than the other two. The head and shoulders pattern indicates that a reversal is possible.

The good thing about this course is that you will be crystal clear about what you need to do from day one. Does not require a lot of indicators to understand or analyze. Part IV. Spread, Lots, Leverage/margin and profit/loss – joining all… Particularly in this example “C” point looks better since first, market has returned right below neck of DB, second, during pullback to C point MACD holds bear trend.

The shoulders should be on the same horizontal plane

You want to make sure that you are looking at a https://traderoom.info/ that is in a downtrend. This is the only type of market where the bullish head and shoulders pattern is reliable. To find the head and shoulder target price, first measure the distance between the head and the neckline. Next, take this distance and subtract it from the neckline breakout level to arrive at the profit target.

The inverted H&S pattern could be found during a bearish trend and it is expected to reverse the downtrend. It forms during a bullish trend and has the potential to reverse the uptrend. The price action then creates a second top, which is higher than the first top. A third top is created afterwards, but it is lower than the second top and is approximately at the same level as the first top. The Head and Shoulders pattern is a chart figure which has a reversal character. As you might image, the name of the formation comes from the visual characteristic of the pattern – it appears in the form of two shoulders and a head in between.

Forex Categories

https://forexhero.info/ and shoulders patterns are not a forex trading strategy on their own. However, they do help us to get a better picture of what is going on and what is going to happen next. Being able to spot these patterns can be the difference between a winning trade and a losing one.

Also, try to find a key https://forexdelta.net/ level that intersects with or at least comes close to the measured objective. This will help you validate the target area and give you a greater degree of confidence during the trade. Referring to the GBPJPY example above, if the market had closed back above the neckline after it closed below it, we would want to exit the trade. Such a close would signal that the pattern is no longer valid and that sellers are no longer in control.

The main differences between them are approaches to analyzing the market situation, opening a position, and monitoring the asset. One of the most comfortable trading methods is Forex swing trade. It does not involve constant monitoring and provides an opportunity to cover essential movements. Trend analysis is a technique used in technical analysis that attempts to predict future stock price movements based on recently observed trend data.

The blue line represents the neck line of the pattern, which goes through the two bottoms at the base of the head. The short trade should be opened when the price action breaches the blue neck line of the pattern. A stop loss should be placed above the second shoulder as shown on the image. Then the size of the pattern needs to be measured in order to attain the minimum potential price move. As you can see, the EUR/USD price enters a bearish trend after the pattern gets confirmed. Fourteen periods after the Head and Shoulders breakout, the price action completes the minimum potential of the pattern.

GBP/USD Forex Signal: Brexit Deal Relief Rally to Fade – DailyForex.com

GBP/USD Forex Signal: Brexit Deal Relief Rally to Fade.

Posted: Tue, 28 Feb 2023 09:59:45 GMT [source]

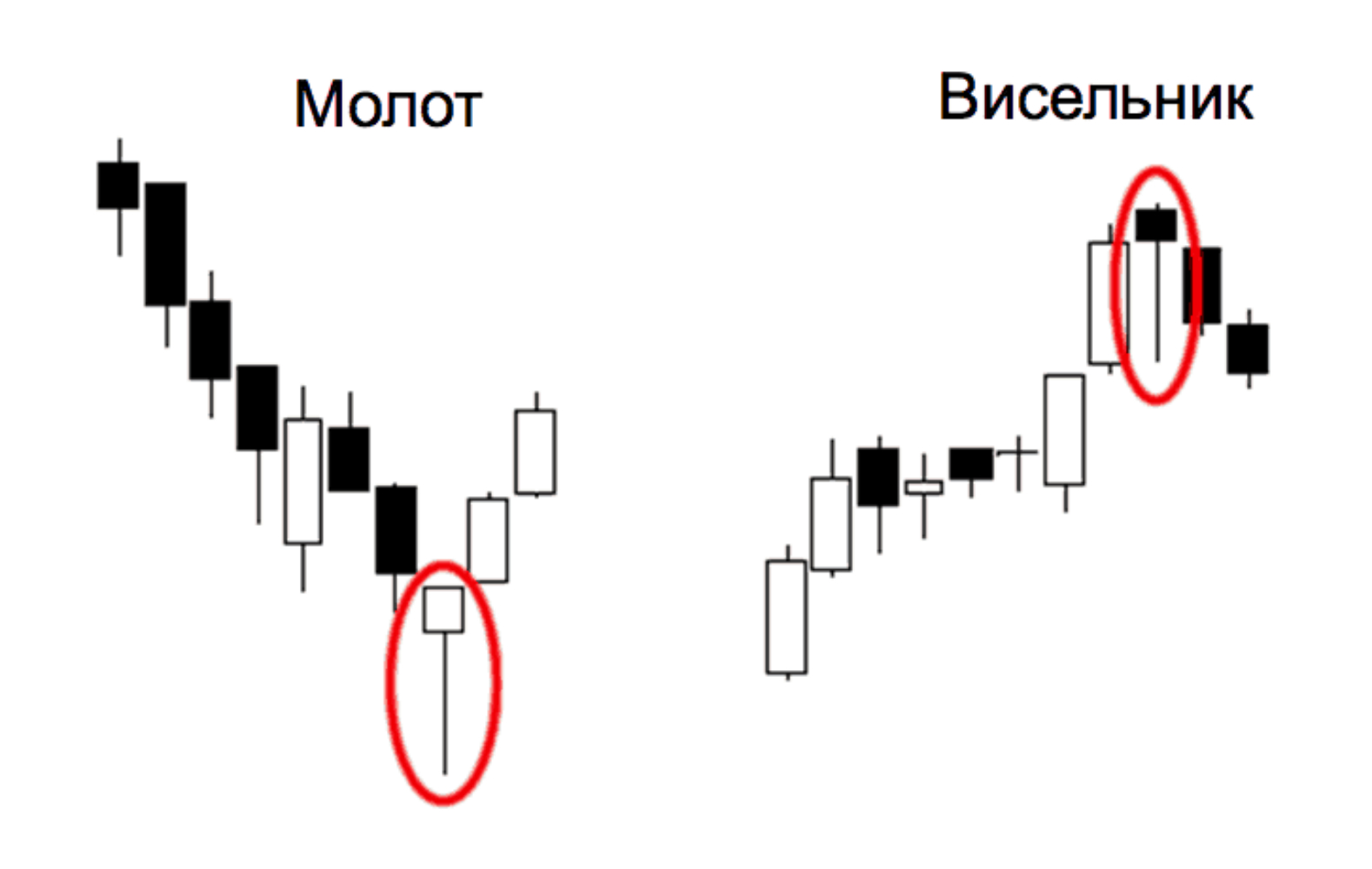

Moreover, this image refers to how to set the stop loss and take profit levels. If you are an aggressive trader, you can put the stop loss above the reversal candlestick with pips buffer. In case the market moves above the neckline and hits your stop loss, it would indicate that the price made a false break below the neckline. However, the conservative approach is to put the stop loss above the left shoulder with some buffer.