An operating cycle can be understood as the average time a business takes to make a sale, collect the payment from the customer, and convert the resources used into cash. Operating cycle refers to number of days a company takes in converting its inventories to cash. It equals the time taken in selling inventories (days inventories outstanding) plus the time taken in recovering cash from trade receivables (days sales outstanding). For example, an efficient sales force can increase the company’s market share and reduce the time it takes to acquire new customers.

Ask Any Financial Question

Days Payable Outstanding (DPO) represents the average number of days it takes for your company to pay its accounts payable to suppliers. A longer DPO indicates that you are retaining cash for a more extended period, which can be advantageous for working capital management. Days Sales Outstanding (DSO) measures the average number of days it takes for your company to collect payments from customers after making a sale. A lower DSO indicates that you are collecting payments promptly, which positively impacts cash flow and liquidity. Have you ever wondered how businesses seamlessly convert investments into cash, ensuring smooth financial operations? In this guide, we’ll unravel the intricacies of the operating cycle, shedding light on its crucial role in financial management.

Best Practices for Managing the Operating Cycle

The longer the operating cycle the greater the level of resources ‘tied up’ in working capital. If you wish to determine how efficiently a business is running, it’s the operating cycle of working capital you should be checking. It is important to note that all companies work towards maintaining a short working capital cycle. Although the operating cycle formula is straightforward, diving deeper into the calculations that lead to the DIO and the DSO can lead to deeper insights. Although you must understand how to calculate the operating cycle if you want to compare yourself to your competitors, it is also important to understand what it really means for your business.

The Benefits of Improving Operating Cycles

Don’t use your working capital to invest in fixed assets such as equipment, land, vehicles, and machines. These are expensive capital assets and if you use working capital to pay for them, there will be a decrease in funds and an increase in the risk of running your business smoothly. When the operating cycle is long, there operating cycle formula are high chances of the company failing to pay adequately. Let us take the example of Apple Inc. to calculate the operating cycle for the financial year ended on September 29, 2018. The following table shows the data for calculation of the operating cycle of company XYZ for the financial year ended on March 31, 20XX.

What is your current financial priority?

- The balance in the Income Summary account is transferred to retained earnings because the net income (or net loss) belongs to the shareholders.

- Implementing these inventory management, accounts receivable, and accounts payable strategies can lead to a more efficient operating cycle, improve cash flow, and enhance overall financial performance for your business.

- When a business trades, it purchases goods, holds them as inventory, converts them to a product for sale and sells them on credit, and finally it collects the cash from the sale.

- Accumulated depreciation records the amount of the asset’s cost that has been expensed since it was put into use.

- The operating cycle, often referred to as the cash conversion cycle, is a fundamental concept in financial management.

- Typically, a shorter operating cycle means a company converts inventory and receivables into cash more quickly.

- These external factors can impact the availability of raw materials and components, affecting the overall efficiency of the operating cycle.

You can also benefit from a smaller inventory cycle, which means you might need to shrink the time between raw materials entering your business and the final product being sold to a customer. Efficient management of the operating cycle is crucial for businesses to improve cash flow, optimize resources, and enhance overall productivity. By understanding the components of the operating cycle and how to calculate it, companies can make informed decisions that positively impact their financial health.

- Looking to streamline your business financial modeling process with a prebuilt customizable template?

- Companies use these materials to manufacture products or provide services to customers.

- Because plant and equipment assets are useful for more than one accounting period, their cost must be spread over the time they are used.

- This section shows how financial statements are prepared using the adjusted trial balance.

- Speaking of a long operating cycle, it suggests that the company is taking too long to sell its inventory and collect cash from customers.

- Also, comparing a company’s current operating cycle to its previous year can help conclude whether its operations are on the path of improvement or not.

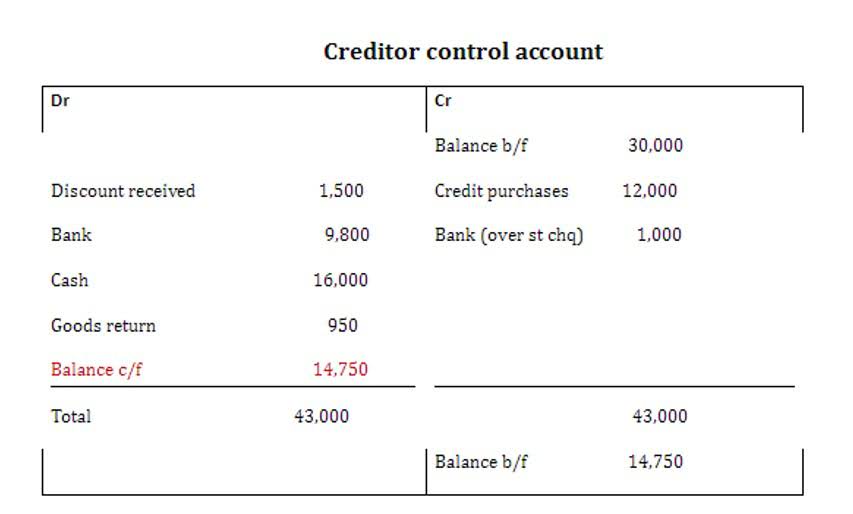

- This figure is essential in understanding how efficiently the company manages its accounts payable.

- The operating cycle represents the time it takes for a company to purchase inventory, convert it into products or services, sell those products or services, and receive cash from customers.

- On the contrary, a long operating cycle creates a negative impact on the cash flow of a business.

- An efficient operational process can also help reduce other costs like marketing, finance, etc.

By familiarizing yourself with the key components of an operating cycle, you can gain insights into how businesses operate and make informed decisions. Implementing these inventory management, accounts receivable, and accounts payable strategies can lead to a more efficient operating cycle, improve cash flow, and enhance overall financial performance for your business. A negative operating cycle occurs when a company’s accounts payable (DPO) period is longer than the combined inventory days and days sales outstanding (DSO) periods. This situation is rare and indicates that the company can collect cash from customers before paying suppliers, resulting in a source of cash flow.

Efficient Accounts Receivable Practices

Related AccountingTools Courses